1. Industry Context: The Strategic Envelope

The industry you are operating within heavily influences the expected topline of the AI use-cases you plan to launch.

This first gate relies on 3 criteria: the regulatory forces & compliance costs of the industry, the maturity of its specific tech ecosystem and the short to long termism investment culture within.

1.1 Regulatory Forces & Compliance Costs

Every AI initiative operates within sector-specific regulatory boundaries that directly shape ROI potential.

Let’s take the example of the access to prescription data from healthcare professionals

- In the US, HIPAA protects patient-identifiable information but allows the use and sale of de-identified physician prescribing data for commercial and research purposes, subject to less stringent controls—this has enabled a robust market for prescription analytics

- In Brazil, regulations are evolving: ANVISA and the Lei Geral de Proteção de Dados (LGPD) oversee health data, with rules similar to GDPR, but enforcement is less mature; prescription data is considered sensitive, and its use is subject to confidentiality and trade secret laws, with access often restricted unless anonymized or aggregated

- In Europe, the GDPR enforces strict controls on personal and health data, making the collection, processing, and commercial use of physician prescription data highly restricted and often requiring explicit consent or strong anonymization

As a consequence, the ROI of using prescription data to target healthcare professionals is strong in the US, average in Brazil and limited in Europe, where most of the time, the data is aggregated at a regional level.

These constraints create “ROI guardrails” that determine feasible use cases.

1.2 Ecosystem Maturity Multipliers

The technological landscape of an industry—particularly the presence of specialized actors and innovative start-ups—plays a critical role in accelerating AI project ROI.

When an industry benefits from a dynamic ecosystem of tech providers, integrators, and niche start-ups, organizations can more rapidly identify, test, and deploy cutting-edge AI solutions tailored to their specific business challenges. This ecosystem fosters collaboration, knowledge sharing, and access to best-in-class tools, reducing development time and integration hurdles.

Furthermore, open source communities and specialized vendors enable companies to experiment with proven frameworks and benefit from collective innovation, which streamlines pilots and shortens time-to-value. As a result, industries with a rich network of AI-focused players are able to scale successful projects faster and realize tangible productivity and efficiency gains sooner, directly impacting their ROI trajectory.

1.3 Longtermism as ROI Accelerator

Industries embracing multi-year planning (e.g., energy, aerospace) realize significantly higher cumulative AI ROI over 5-year periods compared to short-cycle sectors. Long term cycles enable investing into more innovative and bold technologies, while smoothing the cost of project management, with internal recruiting and long term supply planning.

A famous example is BP’s decade-long AI roadmap for predictive maintenance in offshore drilling.

2. Enterprise Implementation Costs: The Execution Layer

The company in which an AI use case is deployed has a significant influence on implementation costs depending on the maturity of 3 assets: the technological foundations, the data governance and the business appetite for AI.

2.1 Tech stack readiness costs

Organizations with modern data infrastructure (cloud data lakes, MLOps pipelines) significantly accelerate implementation of AI use-cases compared to peers relying on legacy systems.

To provide you with estimated figures, establishing a new connection with a source system may take anywhere from a few days to one month, depending on the types of connectors available.

2.2 Data governance debt

A lack of robust data governance significantly reduces the ROI of AI use cases in two main ways.

First, projects are often delayed due to the need for extensive data preparation and the implementation of proper access management, as teams must spend considerable time cleaning, organizing, and securing data before any modeling can begin. Data preparation can consume up to 80% of the effort in machine learning projects.

Second, insufficient governance leads to poor data quality and inadequate labeling, which directly impacts AI performance—models trained on incomplete, inconsistent, or poorly labeled data deliver less accurate and less reliable results, undermining business value and requiring costly rework or extended development cycles.

2.3 Adoption Friction Index

Employee tech affinity and change management capabilities determine whether AI tools deliver value or become shelfware.

If several AI successes have previously paved the way, and employees have access to ongoing AI training programs that help demystify the technology, demonstrate results, and highlight its complementarity with humans, they become significantly more receptive to future AI use cases being launched.

For example, training sessions supporting the launch of an AI product generally include 20% of content dedicated to AI acculturation, along with at least one section on tool access. The more these products are centralized within a single interface and targeted at already trained teams, the more the acculturation effort decreases by 30 to 40%.

3. Multi-Horizon Benefits: The Value Matrix

The benefits of AI use cases are structured around two time horizons to unlock their full value, with gains that vary in tangibility.

The first horizon spans one year and is highly tangible, focusing on gains related to the launch of new products and services made possible by AI, as well as task automation enabled by AI.

The second horizon covers two to three years and is less tangible, involving improvements in strategic decision-making and increased business resilience to market changes through the use of AI.

3.1 Short-Term (0-12 Months)

Topline Growth Engine

The primary method for top-line growth involves enhancing revenue from existing products. In the realm of personalization, consider two illustrative examples: Netflix’s recommendation engine, which boosted customer engagement by 30% and consequently reduced churn. Another example is Stitch Fix, a clothing company that employs AI algorithms to analyze customer preferences and behaviors, thereby delivering tailored clothing recommendations. Such large-scale personalization would be unattainable without AI, and it is precisely this technology that makes Stitch Fix’s business model viable.

The second approach entails launching new products that were previously unprofitable until the advent of AI. For instance, Nutella partnered with Ogilvy Italia to utilize a neural network in creating seven million unique jar labels, all of which sold out within a week. Without AI, producing such a vast number of unique labels would have been prohibitively expensive or simply impossible, rendering the campaign exceptionally profitable.

3.2 Long-Term (12+ Months)

Strategic Decision Superiority

It is always challenging to assess the impact of a strategic decision on a company’s finances, and even more so to evaluate the influence of artificial intelligence in that decision. However, opinions converge in acknowledging that AI has already become a strategic partner in decision-making. An example provided by Artefact is the use of marketing mix modeling, a tool designed to optimize the allocation of the marketing budget across various channels for the following year. In some cases, the profit increase enabled by this optimization can reach up to 40%.

Organizational Resilience

Adopting an AI-driven culture brings agility to organizations by embedding continuous learning, adaptability, and rapid experimentation into everyday operations. AI enables teams to automate routine tasks, detect anomalies quickly, and streamline workflows, freeing up employees to focus on innovation and value creation. This culture encourages decentralized decision-making and empowers teams to test new ideas, analyze results, and iterate on processes in real time, fostering a mindset where change is embraced and failure is seen as a learning opportunity. As a result, organizations become more flexible, better prepared to respond to market shifts, and capable of evolving their strategies and roles to meet emerging challenges—making agility a core part of their identity and operational strength.

Ninety percent of companies surveyed in a Dataiku study consider AI to be a tool of resilience in the face of recession risk and economic crises. More than 80% of managers report maintaining or increasing their investments in AI despite economic uncertainties, reflecting strong confidence in AI’s ability to protect businesses against disruptions.

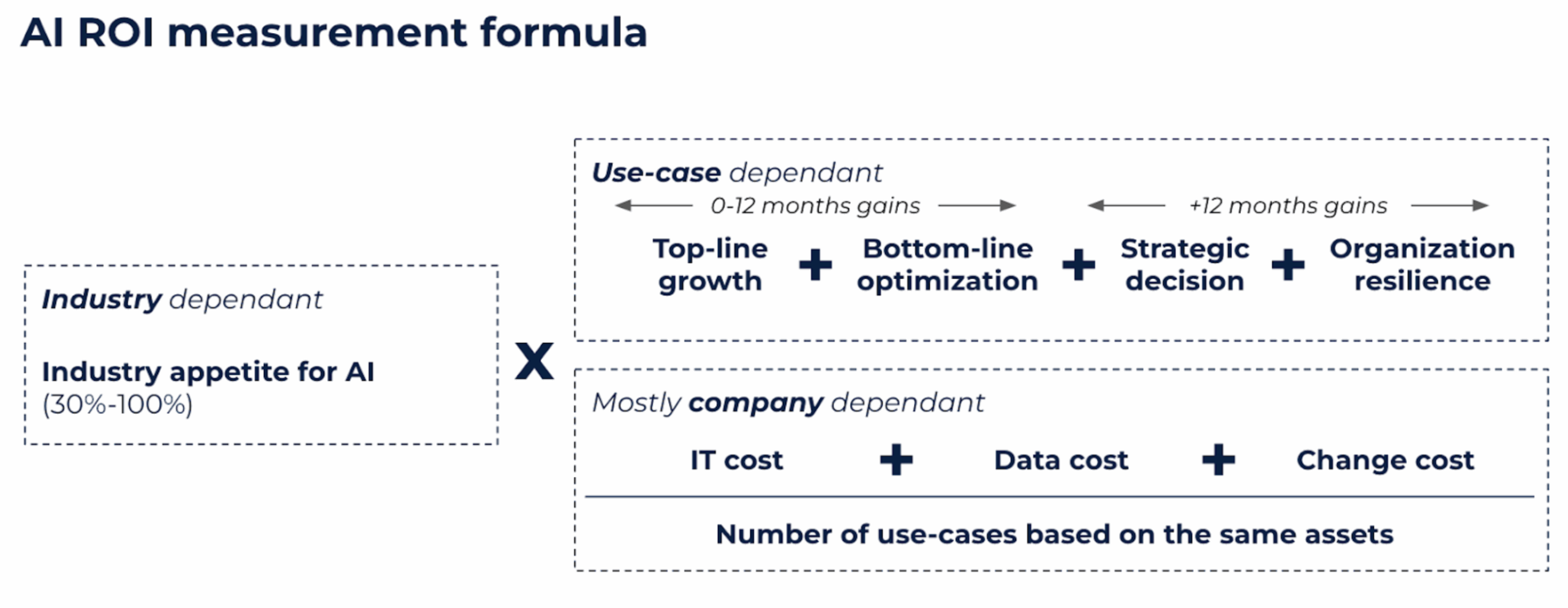

The Concentric ROI Framework

Based on all the aforementioned factors, we propose the following formula for calculating the ROI of an AI use case, which depends on three levels: industry, company, and the rationalization of use cases around IT, data, and change management costs. Although evaluating each factor is complex, this formula will help you keep in mind all the elements to be considered.

Conclusion: Balancing the ROI Equation

This framework moves beyond static cost-benefit analysis to model AI’s cascading impacts:

- Industry forces set the ROI playing field

- Enterprise readiness determines entry costs

- Benefit horizons compound over time

In our final article, we’ll explore how to operationalize this framework through 2 examples from the healthcare industry, with one oriented on the 0–12 months ROI and one +12 months oriented.

BLOG

BLOG