The private equity industry is increasingly competitive and data-intensive, where speed and accuracy are paramount factors of success. World-leading private investment firm Ardian, managing $192 billion in assets across private equity, real assets, and credit, recognized that the sheer volume of unstructured documents and the challenge of “information overload” posed significant hurdles to rapid deal execution and high-value strategic analysis.

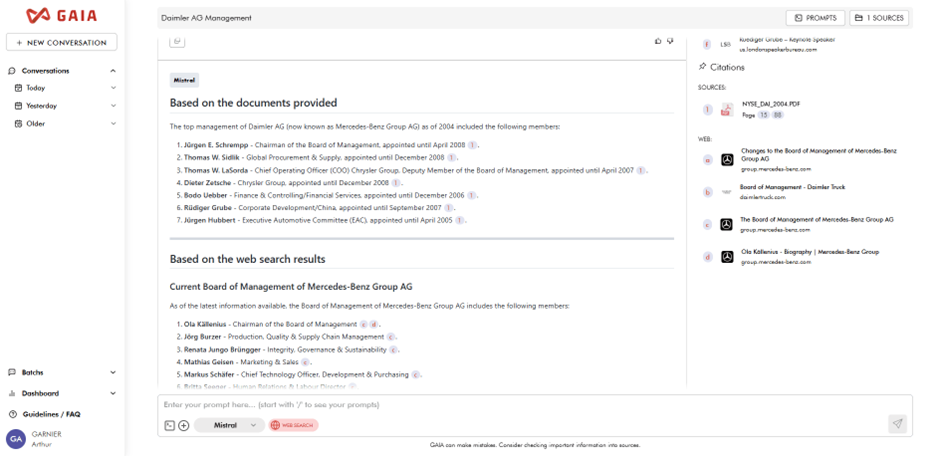

To stay ahead of the market and enhance decision-making capabilities, Ardian partnered with Artefact and Mistral AI to tackle a universal challenge in private equity: document overload and information silos. The result of this collaboration is GAIA, an internal generative AI platform that is fundamentally transforming how Ardian’s investment teams analyze and extract insights from complex, unstructured documents such as market reports, due diligence documents, financial filings, and legal memoranda.

The challenge: From data-driven to document-driven

Before the implementation of GAIA, Ardian’s data science initiatives focused mainly on numerical data and traditional machine learning models. While valuable, this approach was limited by the nature of private equity work, which relies heavily on analyzing massive quantities of unstructured text, PDFs, and qualitative reports.

Investment teams must screen hundreds of pages for each potential deal as efficiently as possible, extracting critical information to support their analysis. As Arthur Garnier, Senior Data Scientist and IT Chief of Staff at Ardian, explained, “Teams receive long, complex documents – hundreds of pages. It’s critical to distinguish signal from noise quickly”. The firm’s primary challenges included both accessing internal documents scattered across various systems under strict NDA requirements, and the need for rapid analysis of vast information volumes. The goal was clear: empower human analysis by enabling teams to extract crucial information more swiftly.

GAIA: A secure, model-agnostic platform for document intelligence

To realize the transformative potential of generative AI, Ardian, in partnership with Artefact, developed and launched GAIA in full production within one year. The platform is powered by a selection of AI models, including Mistral AI, and was built to address the specific needs of an organization handling confidential financial information.

The technical architecture of GAIA prioritizes security and compliance, an essential component for private equity. This includes strict security protocols, data governance, and manual document uploads to ensure an additional layer of human oversight.

A key decision in the platform’s development was adopting a model-agnostic approach. Recognizing that a single model couldn’t meet every need, Ardian chose to integrate Mistral AI alongside other models to ensure flexibility and optimized performance for specific tasks.

Mistral AI models were selected for several compelling reasons, which aligned perfectly with Ardian’s European focus and compliance needs:

- European data sovereignty alignment: Essential for meeting private equity compliance requirements.

- Superior multilingual performance: Particularly strong with French documents, which is crucial for European deals.

- Excellent summarization capabilities: Highly effective for processing large financial document corpora.

- Model flexibility: Enabling specialized optimization for different financial analysis tasks.

GAIA now allows users across all teams to upload internal documents and interact with them using natural language queries. This provides a rapid “first-pass analysis” of complex materials, with the platform also offering web search capabilities and permanent folders for team collaboration. “For the first time, enterprise-grade tech worked well with unstructured data,” noted Arthur Garnier.

Dramatic impact and exponential adoption

The adoption and impact of GAIA within Ardian have exceeded expectations, delivering dramatic acceleration in deal analysis and enhanced team productivity.

Mathias Burghardt, Executive Vice-President of Ardian and CEO of Ardian France, highlighted the platform’s success: “In less than a year, daily usage has tripled, with over 500 weekly active users and more than 280,000 user requests. Today, more than half of Ardian’s employees use GAIA to accelerate their work and focus on delivering value for our investors and portfolio companies.”

The practical value is evident in the results:

- 2X increase in weekly active users

- 2X growth in documents processed

- 200K+ AI-powered queries generated

As a result, teams are now empowered with much more clarified and organized information, which allows extra room for higher value-added tasks. Instead of merely reducing the time spent on analysis, GAIA enables teams to conduct more thorough due diligence and potentially evaluate additional investment opportunities.

GAIA’s uniqueness lies not only in its technology but in the collaborative spirit that built it, combining the expertise of Ardian’s Data Science, IT, and Digital Transformation teams with the strengths of Mistral AI and the expertise of Artefact.

The future: Expanding the scope of investment analysis

Building on the initial success of document analysis, Ardian is already planning the next phase of GAIA. The focus is on enhancing the platform with advanced reasoning capabilities for more complex deal evaluation. This includes utilizing Mistral AI’s reasoning capabilities for automated subquery generation.

The goal is to enable users to ask broad, general questions such as “What are the risks of this deal?” and receive comprehensive analysis across multiple financial risk categories, leveraging AI to truly understand private equity-specific financial metrics and risk frameworks.

This successful collaboration between Ardian, Mistral AI, and Artefact demonstrates that by strategically leveraging generative AI, major financial institutions can securely and effectively transform core workflows. Ardian is not just adopting new tools; it is pioneering a new standard for document intelligence in the private equity world, accelerating deal execution, and cementing its competitive advantage. Ardian is also extending these benefits to its portfolio companies by sharing best practices and AI-driven strategies across the Ardian ecosystem.

CLIENT CASES

CLIENT CASES