Author

The Private Equity Landscape Amidst Market Volatility

The Current US Environment

The US private equity market is navigating a period of heightened uncertainty. Persistent inflation, rising interest rates, geopolitical instability, and banking sector turbulence have created a volatile macroeconomic environment. Deal volume in the US private equity market declined by 25% in 2023 compared to the previous year, as firms faced tighter credit markets and increased investor caution (Source: PitchBook, 2023). This challenging environment is compelling private equity firms to rethink their strategies and find innovative ways to drive value creation.

The Growing Role of Generative AI

Generative AI (GenAI) is emerging as a transformative force in private equity, offering firms the ability to enhance deal sourcing, portfolio monitoring, and operational efficiency. Early adopters of AI have reported up to a 30% improvement in operational efficiency within the first year of implementation (Source: McKinsey, 2023), underscoring the potential of this technology to reshape the industry. However, as firms embrace GenAI, the need for a robust governance framework becomes critical to mitigate risks such as biased decision-making, regulatory non-compliance, and data security vulnerabilities.

At Artefact we are uniquely positioned to help private equity firms navigate this complex landscape. With over 1,700 employees across 28 offices worldwide and a proven track record of working with leading global brands and PE-backed companies, we are at the forefront of AI adoption in private equity to generate higher ROI.

1.At the Portfolio Company Level

We have developed a comprehensive suite of solutions to help portfolio companies harness the power of AI and GenAI, driving growth and operational efficiency. These solutions are designed to address the unique challenges faced by PE-backed businesses and include:

- AI Maturity Assessment: Artefact evaluates AI and digital readiness across the organization, identifying opportunities and risks. This includes the introduction of a GenAI Disruption Index, which assesses the potential impact of GenAI on business models and operations. Research indicates that companies with high AI maturity are better positioned to outperform competitors, with AI-driven personalization strategies increasing revenue by 10–15% (Source: Boston Consulting Group, 2023).

- Growth Acceleration: By defining and implementing tailored AI/GenAI strategies, Artefact helps portfolio companies scale rapidly. For example, AI-powered customer segmentation and marketing automation have enabled companies to achieve double-digit revenue growth in as little as six months (Source: Gartner, 2023).

- AI Transformation: Artefact provides end-to-end support for integrating AI and GenAI into core business processes. From strategy development to execution, this transformation ensures portfolio companies can unlock efficiencies and capitalize on emerging opportunities.

- AI Enablement: Training programs for senior management build AI fluency and autonomy, ensuring leadership is equipped to steer AI initiatives effectively. Firms that prioritize AI enablement report faster adoption rates and higher returns on investment (Source: Deloitte, 2023).

2. At the Fund Level

Artefact’s solutions for private equity funds are built on two key proprietary assets that enable firms to leverage AI at scale:

- Unified Data Platform: Artefact aggregates accessible data from all funds into a centralized platform, enabling seamless analysis and insights across the portfolio. Firms that centralize portfolio data report a 15–20% reduction in reporting time, allowing decision-makers to act faster and with greater confidence (Source: Bain & Company, 2023).

- AI Bedrock: Modular AI capabilities designed as foundational building blocks can be freely reassembled to support future use cases. Tailored to fund-specific needs and constraints, AI Bedrock provides the flexibility and scalability required to address evolving challenges while maintaining operational efficiency.

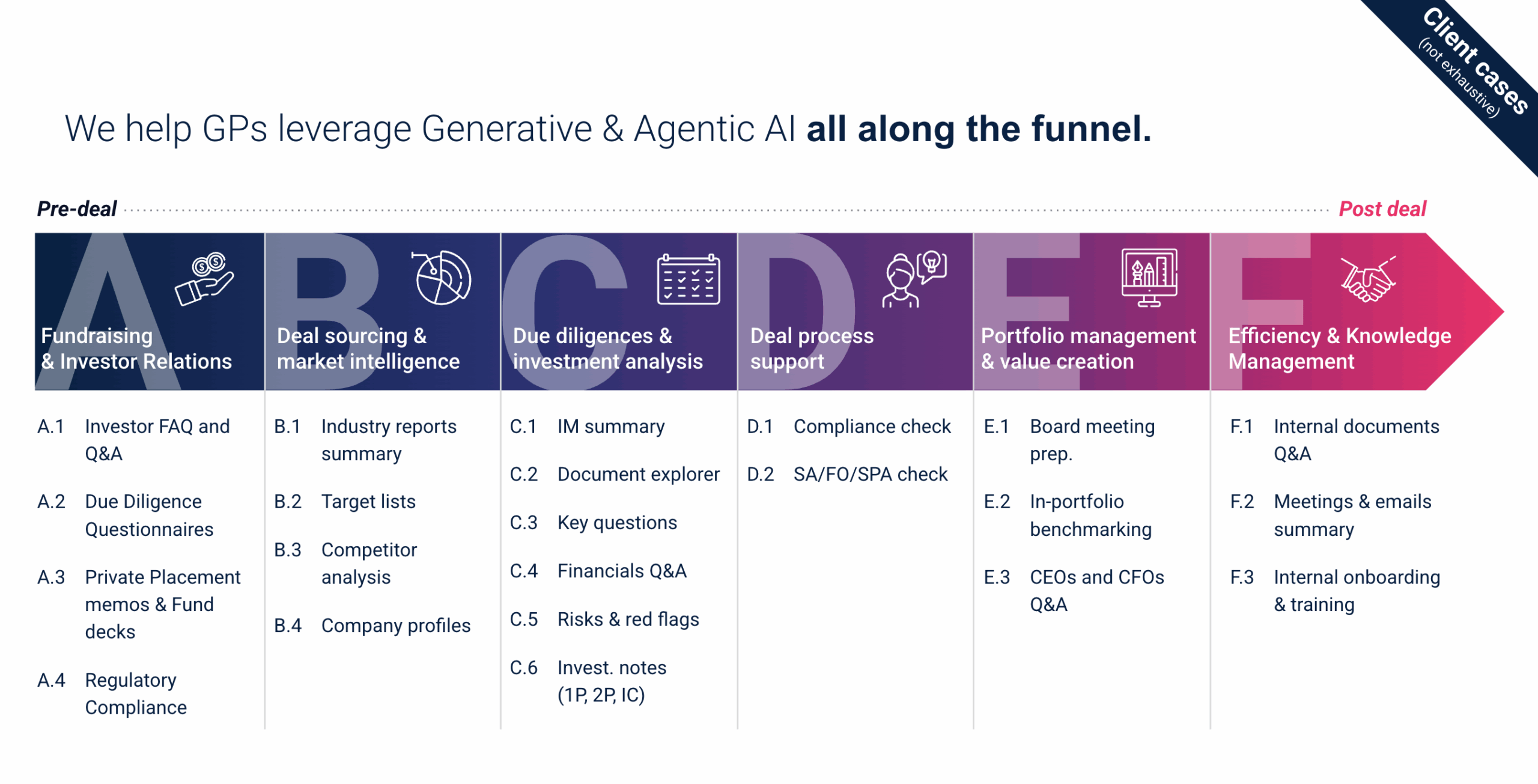

Artefact’s solutions for private equity funds are designed to support General Partners (GPs) across the entire investment lifecycle (pre-deal to post deal), leveraging Generative AI and Agentic AI to improve efficiency, decision-making, and value creation.

From Insight to Impact: Artefact’s AI solutions in the field

- Artefact and Ardian: By deploying AI-driven solutions across Ardian’s operations and portfolio companies, Artefact has helped optimize deal sourcing, portfolio monitoring, and operational efficiency. For Ardian’s portfolio companies, AI-powered tools have streamlined marketing strategies and supply chain operations, resulting in a 15% increase in operational efficiency and a 12% reduction in costs within the first year (Source: Ardian Internal Data, 2023).

- Private Equity Fund Optimization: Artefact worked with a mid-sized US private equity firm to implement AI-driven portfolio monitoring tools. By enabling real-time KPI tracking and predictive analytics, the firm reduced reporting time by 40% and identified early warning signs in underperforming assets, allowing for proactive interventions.

- Portfolio Company Transformation: Artefact collaborated with a retail portfolio company to deploy AI-powered customer segmentation and GenAI-driven content creation for marketing campaigns. Within six months, the company achieved a 15% increase in revenue, demonstrating the power of AI to accelerate growth in competitive industries (Source: Gartner, 2023).Strong of a unique combination of industry expertise and cutting-edge AI technology we are the trusted partner for private equity firms. We combine local market knowledge with global expertise to deliver tailored solutions that address the specific challenges faced by private equity funds and their portfolio companies.

Empowering the Future of Private Equity

By 2030, AI is projected to contribute $15.7 trillion to the global economy, with early adopters capturing the lion’s share of this value (Source: PwC, 2023).

With an evolving private equity landscape, it is becoming critical to embrace AI and GenAI to navigate current volatility and unlock new growth opportunities. Artefact’s tailored offerings ensure that private equity firms can adopt these technologies effectively, driving growth, operational excellence, and resilience.

Contact our Hortense Viard, our Private Equity AI specialist to discuss how Artefact can support your firm’s AI roadmap.

BLOG

BLOG