Findings from the C-Suites of leading global companies.

Today, ESG data reveals operational inefficiencies, accelerates modernization, and aligns organizations around a shared vision.

Nearly 80% of executives interviewed stress that ESG indicators inherit the strengths and weaknesses of the company’s operational systems. Because ESG data draws from procurement, HR, logistics, product composition, and energy systems, it exposes weaknesses that were previously overlooked.

ESG measurement and integration act as an X-ray of operational reality, revealing gaps such as:

- Missing supplier IDs

- Incomplete product references

- Inconsistent measurement cycles

- Outdated data models

“CSR requires highly detailed information… Since it pushes us to analyze entire ecosystems, it ultimately provides deep knowledge and mastery of all the company’s activities.” – Audrey Leclerc, Sustainability Quality, Transformation Director, Siplec

ESG data multiplies organizational performance

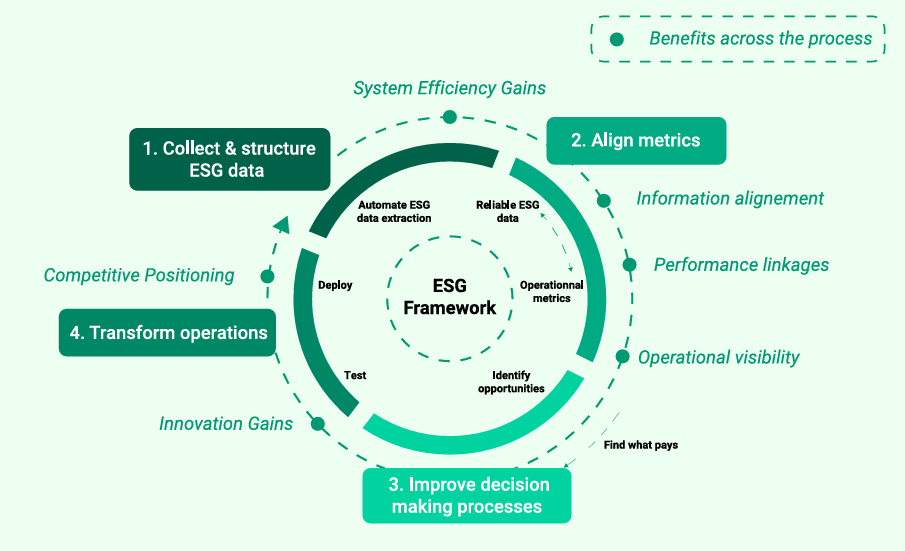

Three categories of value emerged repeatedly across executive interviews:

1) System efficiency gains: Integrating ESG requirements forces organizations to unify fragmented systems. Pipelines created for sustainability indicators are reused across finance and operations, accelerating reporting cycles and cutting manual effort.

2) Information alignment: ESG measurement compels functions to work from shared definitions, data models, and reporting calendars, reducing ambiguity and improving cross-functional decision-making.

3) Performance linkage: When ESG indicators connect to financial data, leaders can uncover new opportunities:

- Carbon tracking reveals hidden cost savings

- Supplier sustainability performance predicts supply-chain resilience

- Waste metrics reveal margin erosion

“Sustainability becomes profitable because it enhances performance and unlocks financial levers that didn’t exist before.” – Alexandre Musso, Sustainability Performance Director, Accor

When integrated into decision-making, ESG data elevates the entire ecosystem

ESG requirements imposed by large purchasers have a contagion effect across supplier networks. Sustainability becomes a qualifier for business relationships, unlocking opportunities for:

- Competitive positioning: The ability to produce robust ESG data is now a differentiator in B2B negotiations, procurement scoring, and investor relations.

- Innovation gains: ESG data highlights inefficiencies that also represent innovation potential that can strengthen both margins and reputation.

- Collective learning: By expanding the industry’s knowledge base, ESG data evolves into an open infrastructure of comparable standards that benefits the entire market.

“When a major player integrates ESG into its strategy, it sends a powerful signal to the entire ecosystem — suppliers and partners naturally follow, creating a strong positive momentum.” – Elina Ashkinazi-Ildis, Partner, Artefact

Designing profit-driven sustainability: Lessons from the field.

Multiple in-depth case studies reveal what separates successful ESG initiatives from stalled efforts. Over 90% of executives agree that the real story starts upstream by embedding ESG data where value begins: ESG succeeds when indicators are defined before implementation. Data must be integrated into operational systems from the start, not reconstructed retrospectively.

Case Study 1: Siplec (E.Leclerc Group)

Rather than collecting ESG information retrospectively for reporting purposes, Siplec integrates ESG metrics directly into operational systems covering retail activities, logistics, and supplier networks. Outcomes include:

- Improved data quality and auditability

- Reduced reporting burden

- Stronger alignment between sustainability and operations

- Modernization of data infrastructures

This design ensures that ESG data follows the project lifecycle from the outset, rather than being reconstructed ex post. Integration within the company’s data architecture guarantees traceability, comparability, and alignment between sustainability objectives and business performance indicators.

The highest-performing companies treat sustainability not as a reporting function but as an internal advisory unit that aligns ESG with operational priorities.

Case Study 2: Accor

Accor’s global phase-out of single-use plastics demonstrates how sustainability becomes a shared management system:

- Cross-functional governance (Procurement, Operations, Marketing)

- Dual monitoring (ESG + operational KPIs)

- Monthly executive reviews

- Fast escalation of bottlenecks

The sustainability team established a list of around fifty single-use plastic items to be eliminated or replaced. ESG data tracking enabled leaders to identify bottlenecks, compare progress across regions, and redirect resources.

The result: sustainability embedded into the business cadence, not separated from it.

Case Study 3: Ardian

For Ardian, ESG indicators, taken in isolation, do not convey meaning. Emissions, diversity, or governance scores acquire strategic value only when they are connected to business context, time, entity, sector, and financial performance.

“A single ESG datapoint has no meaning. It only acquires value when connected to its context.” – David Chemla, Sustainability Director – Data & AI, Ardian

Ardian decided to build a platform linking ESG data directly to financial and operational datasets:

- Carbon intensity -> EBITDA

- Diversity metrics -> value creation

- Compliance -> portfolio resilience

The result transforms ESG from a reporting artifact into an engine for investment decisions and lays the foundation for AI use cases.

Case Study 4: Legrand

Legrand’s sustainability strategy is increasingly powered by data-driven modeling. By systematically collecting information on materials, transport, and production processes, the group is constructing a digital twin of its operations: a virtual replica of the company’s industrial and logistical network, integrating sustainability, materials, logistics, and production data.

In this way, Legrand is turning data into a strategic capability. The digital twin vision acts as a shared platform across business units, enabling collaboration between R&D, manufacturing, logistics, and CSR teams.

“For us, ESG data must go beyond compliance –it has to generate business performance. In the long run, we want a performance engine: a system that transforms compliance data into operational intelligence.” – Vincent Wang, Chief Digital Officer, Legrand

Case Study 5: Tarkett

Companies that pursue circularity ultimately rethink value creation: product innovation leads to new models such as leasing, take-back, or product-as-a-service.

Tarkett’s ReStart® programme transforms recycling into a scalable business model:

- 4,000–5,000 tonnes collected per year

- 60% recycled into new products

- Deployed in 29 countries

- 124,000 tonnes recycled in 14 years

This strengthens supply-chain resilience, reduces virgin material dependence, and builds long-term customer loyalty.

“When working on circularity, we don’t just change the material — we change how the business operates.” – Arnaud Marquis, Chief Sustainability and Safety Officer, Tarkett

Case Study 6: Heineken Brazil SPIN Programme

Leaders are shifting from value-chain optimization to ecosystem orchestration.

Heineken Brazil’s main sustainability issues include glass recycling, water resilience, and carbon emissions. They created a program to turn them into an impact ecosystem designed to change the investment logic from operational cost to strategic asset. The results:

- R$250 million in revenue generated

- Measurable improvements in recycling and biodiversity

- Creation of an “impact cell” for innovation governance

- ESG is positioned not as a constraint but as a growth engine

Case Study 7: ALSglobal

ALSglobal knows that DEI delivers impact only when treated as a performance system with goals, ownership, measurement, and accountability. To build an inclusive organization with data, the company embeds DEI metrics into HR and sustainability platforms, resulting in:

- Measurable goals in recruitment, leadership, pay equity

- Lifecycle tracking from hiring to promotion

- Board-level reviews

- Strengthened employee trust through transparent reporting

“When diversity, ESG, and data governance are approached as forces of transformation, they redefine the realm of possibilities, cultivating a shared intelligence capable of deciding with fairness and foresight.” – Imad Moumin, Chief Financial Officer, Schenker Maroc

Three imperatives will shape the future of sustainability performance.

- ESG initiatives must create demonstrable value. The era of sustainability justified solely on brand reputation is over. As HBR notes, high-performing successful ESG projects reduce energy intensity, improve capital access, and strengthen retention — outcomes that attract further investment and talent. CompaniesC-suites must therefore design projects with measurable financial and operational outcomes from the outset.

- ESG data governance must match financial data governance. Fragmented spreadsheets are no longer adequate. Leaders are investing in integrated platforms that ensure accuracy, comparability, and auditability, — mirroring the rigor of financial reporting. As the ebook notes, firms with robust ESG data systems make faster decisions and achieve stronger financial results.

- Sustainability must be embedded into governance, incentives, and culture. Boards and executives must cascade ESG objectives into business units and performance management. Sustainability becomes a lever for agility: firms with embedded ESG frameworks respond more effectively to regulatory change, investor scrutiny, and societal expectations.

A C-suite blueprint for successful ESG execution.

The ebook provides Artefact’s proposed framework for a successful sustainability strategy…

…as well as a comprehensive list of “dos and don’ts”:

Common pitfalls:

- Starting measurement too late

- Collecting more indicators than can be used

- Relying on Excel rebuilds every year

- Treating ESG as a reporting function

- Keeping sustainability siloed

- Ignoring financial context

Critical success factors:

- Embedding data teams from the start

- Defining KPIs pre-execution

- Prioritizing consistency over volume

- Integrating ESG and financial indicators

- Establishing shared ownership across CSR, IT, procurement, finance, and operations

- Contextualizing all indicators

- Automating where possible

- Making ESG part of the organization’s performance culture

Conclusion: ESG data as a core capability for the next decade.

The evidence across industries is unequivocal: ESG data has become a core management language that drives growth, innovation, and resilience. Firms that institutionalize ESG data governance, treating it with the rigor of financial systems, unlock:

- Better operational visibility

- Faster decisions

- Reduced costs

- Stronger supplier alignment

- Heightened investor confidence

- New revenue streams

- More resilient business models

The winners of the next decade will be those who move from static reporting to dynamic, automated systems, contextualize ESG indicators with operational and financial data, embed ESG into governance, incentives, and culture, and invest in architecture that links impact to profitability.

In short, ESG data is no longer a compliance necessity: it is a competitive capability. C-suite leaders who build it into the foundation of their enterprise will convert sustainability into measurable performance and long-term growth.

BLOG

BLOG