TL,DR:

- Why it matters: Siloed data is a costly drag: leaders are convinced it harms daily decisions and fragmented data bleeds US $3.1 trillion a year, just as retail‑media spend races toward US $140 billion by 2026. Collaboration is the only way to unlock that value.

- What makes it work: Success of data collaboration among retailers and industry comprises on two pillars: smooth system integration and strong data‑governance rules (often enforced in privacy‑safe clean rooms). Without them, disconnected tools, low trust, and messy data keep collaboration stuck in first gear.

- What it delivers: Real‑world pilots already show the upside: Cdiscount & Mattel gained +600 % ROAS, Carrefour Links drove +18 % revenue for Magnum, and ADEO cut product‑data errors 35 %, while AI promises to scale these wins as the retail‑AI market heads for US $40 billion by 2030.

Breaking the Silos: Why shared data is Retail’s next competitive edge

Retail is going through a big change as customers expect more, competition grows, and businesses seek to work smarter. Data has become the backbone to helping retailers understand what people want, manage inventory, improve supply chains, and offer the right products, hence using data and technology to guide decisions is essential. To succeed, retailers must not only manage their own data well but also work closely with partners across the value chain. The impact is clear:

- More accurate demand and supply planning: Sharing sales and stock data helps align supply with actual demand, reducing overstock and stockouts.

- Faster stock turnover: With visibility into product performance, CPG companies can optimise assortment and replenishment, helping retailers keep the right items on the shelf.

- More precise positioning: Pricing competitiveness vision and insights can help CPGs’ RGM teams to define targeted strategies, whereas reinforcing Retails’ positioning.

- Fewer lost sales: Empty shelves frustrate customers. When suppliers see what’s missing in real time, they can respond faster and keep inventory flowing.

- Less waste, better margins: Avoiding excess inventory saves on storage and prevents tied-up capital. It’s a win for sustainability too.

- More shopper-driven innovation and category growth: By understanding shopper behaviours across different retailers, CPGs can tailor their marketing and innovation strategies, influencing both R&D and category management with greater precision.

- Smarter decisions at every level: Reliable data fuels advanced analytics and AI models that can automate forecasting, personalise offers, and streamline operations.

The problem? Most of that data is still locked in separate systems. A Harvard Business Review survey found that 84 % of executives feel the negative impact of data silos on day-to-day decisions, while Salesforce’s 2024 Connectivity Report shows 81 % of IT leaders say those silos are slowing digital-transformation efforts. Add in IDC’s estimate that fragmented data drains US $3.1 trillion from the global economy each year, and the urgency is clear: until retailers can connect loyalty, supply-chain, media, and supplier datasets in a privacy-safe way, they will continue to leave revenue and customer trust on the table.

What is exactly Data Collaboration when we look at the retail industry?

Many organizations get their key market data from data providers (e.g., Neogrid and Nielsen) using one-to-one data sharing agreements, that are formal contracts between companies defining the terms, reasons, and conditions under which data is exchanged.

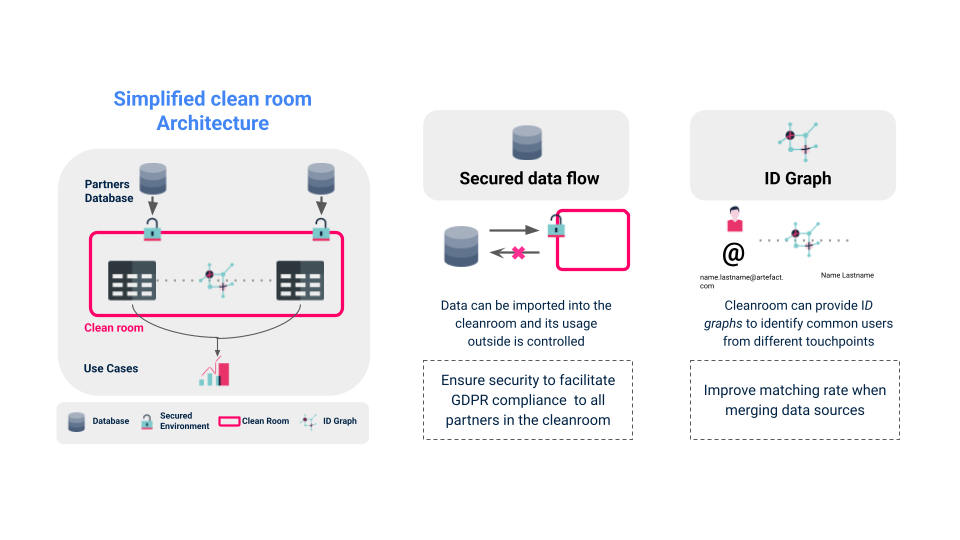

However, a new format has arisen: the data sharing between industry and retailers without exchanging or copying it, but actually using a secure clean-room technology, that allows direct interaction within a secure environment.

Clean rooms are secure, privacy-compliant environments where two or more parties can analyze combined datasets without exposing any raw or personally identifiable data. They act as neutral, governed spaces that allow joint planning, measurement, and activation—enabling collaboration while preserving confidentiality and compliance.

This new paradigm is more beneficial for both retailers and industries than traditional one-to-one data contracts since it eliminates the need for managing multiple one-off agreements, reduces friction, legal overhead, and setup time for partners to collaborate.

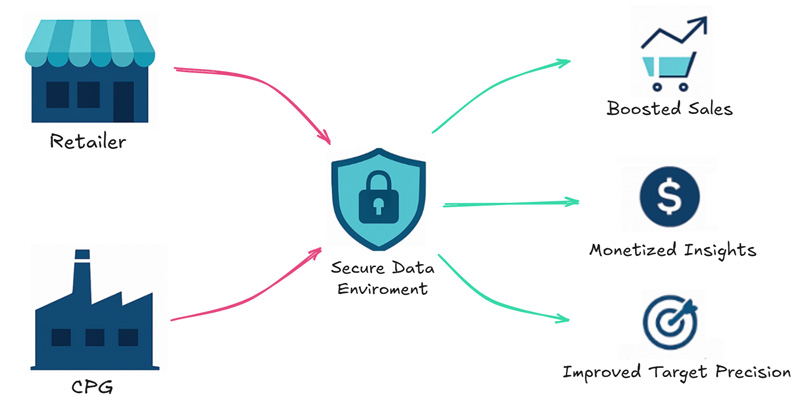

Example 1: A retailer and a CPG snack food producer securely combine their first-party data and sales data from one side and campaign exposure from the other. Without sharing raw data, they find insights like which audiences respond best to in-store versus online promotions or when to push cross-sell offers. Both sides would gain: the brand boosts sales and improves its targeting precision, whereas the retailer enhances its media offering and monetizes insights.

Example 2: A retailer shares near real-time data on out-of-stocks and turnover, giving the supplier enough visibility to quickly adjust its production and logistics. No raw data needed, just the right updates at the right time. As a result, customers find what they’re looking for, the retailer avoids lost sales, and the supplier operates more efficiently.

What happens when retailers and partners really share data?

In today’s retail environment, data collaboration has moved from a nice-to-have to a must-have, especially when it comes to marketing. Sharing insights with trusted partners, such as brands and marketplaces, allows retailers to better understand customer behavior, deliver personalized experiences, and unlock new revenue opportunities. With retail media rising, data collaboration has become a powerful engine for both efficiency and monetization.

The global retail media market is expected to reach US $140 billion by 2026. Its effectiveness stems from combining retailers’ valuable first-party shopper data with activation tools, enabling brands to target the ideal audience at the optimal moment and on the most suitable platform. But none of this works without collaboration: retailers and brands must align their approaches to data sharing, activation, and measurement in order to get results. Here are a few examples of how retailers are benefiting from data collaboration in marketing:

- Cdiscount & Mattel: By sharing real-time shopper signals through clean room technology (discussed later), Cdiscount enabled Mattel to adjust campaigns based on stock, audience behavior, and ad performance, which resulted in a 600% increase in return on ad spend and up to 10 euros in revenue per euro invested.

- Carrefour Links: Through the Carrefour Links platform, the company safely shares customer insights with partners like Unilever, that besides enabling better understanding of their data, resulted in a successful data-driven campaign, with +18% revenue for Magnum Brand.

These examples show how a well-implemented data sharing can deliver value beyond just marketing performance. It creates closer collaboration across the ecosystem, increases speed to action, and opens new doors to growth. But despite the clear benefits, many retailers still struggle to scale these efforts across teams and partners.

That’s because unlocking the full value of shared data depends on two key ingredients: interoperability and governance. Systems must seamlessly integrate to each other, and the data being shared must be clean, consistent, and well-managed. Without this foundation, even the most advanced retail media strategy won’t achieve its full potential.

From Silos to Synergy: How retailers are turning shared data into shared growth

Despite the clear benefits of data sharing, many retailers still struggle to make their systems and data work together. Interoperability, the ability of systems to exchange and use shared data, is often the missing link leaving the information trapped in silos.

But connecting systems is only part of the equation. For shared data to really be useful, it must be clean, consistent, and trustworthy. That’s where data governance comes in. Think of governance as the rulebook for shared data. It defines how data is structured, who owns it, how it can be accessed, and how it’s kept secure. When this foundation is strong, insights are generated faster and more reliably.

Governance also helps define clear ownership, which is essential for scaling collaboration across growing ecosystems of suppliers, tech partners, and marketplaces. But when sensitive customer or campaign data is involved, privacy and security are non-negotiable. This is where clean rooms come into play. It ensures data stays protected while enabling joint planning, campaign activation, and measurement.

One global sports brand used this setup to solve a common challenge: understanding what actually drives conversions across media channels. Traditional tracking methods weren’t enough. By leveraging a clean room to securely combine campaign and conversion data, they found out what was really working and optimized their spend across regions. It’s a powerful example of how interoperability, governance, and privacy can work together to drive better business outcomes. But putting this into practice is not always easy. So how can companies turn these principles into action?

Building Bridges: Making Data Collaboration Work

Scaling data collaboration sounds great on paper, implementation presents significant challenges for retailers. Here’s how companies can start tackling them:

- Disconnected operations, systems and teams: Marketing, supply chain, and sales often work on their own, making it hard to get a comprehensive view of operations. When external partners come up with different tools and formats, this complexity goes further. To fix this, companies should invest in shared data models, cross-functional teams, and integration tools that speak a common language to bridge gaps and align goals.

- Lack of trust in a competitive environment: Companies are naturally cautious about sharing data, even when collaboration could lead to better outcomes. Privacy regulations such as GDPR require this caution, but they also add legal and technical hurdles that slow down the process. Secure environments like data clean rooms and clear governance policies help partners collaborate without leaking sensitive information.

- Poor data quality and inconsistent standard: Inconsistent formats, outdated information, and lack of clear standards create confusion and inefficiencies. When teams can’t trust their data, decision-making becomes slower, or even worse, misinformed. Retailers should start by defining internal standards and cleaning their data at the source. Shared data categories and agreed-upon schemas make combined analysis smoother and far more reliable.

- Pressure to show quick wins: With spread data and growing complexity, many initiatives lose strength before a broader adoption. By starting with Most Viable Products (MVPs) that solve real business questions, teams can prove value fast and build momentum across the organization.

By establishing a strong foundation, powered by governance and secure sharing environments, retailers can unlock tangible and measurable benefits. And the impact of these efforts grows exponentially when integrated with advanced technologies.

AI Technologies Shaping the Future of Data Collaboration

The global artificial intelligence in retail market is expected to grow at a compound annual growth rate (CAGR) of 23.0% from 2025 to 2030, reaching US $ 40.74 billion by 2030. AI, Generative AI (GenAI), and Agentic AI are no longer just buzzwords, they are powerful enablers of smarter, faster, and more secure data collaboration. For retailers, these technologies offer new ways to streamline operations, unlock insight across teams, and foster effective partnerships. From automating repetitive tasks to generating content and making real-time decisions, advanced AI tools are helping organizations overcome historical roadblocks to data sharing.

A good example on how to leverage AI is the case of ADEO Group, parent company of Leroy Merlin. Facing messy, inconsistent product data coming from multiple suppliers, ADEO used AI to tackle them, getting impressive results:

- Over 96% precision for 63% of products, using AI to classify and enrich product data across 3,600 categories and 85,000 attributes, turning scattered supplier information into a reliable source of truth.

- 35% fewer errors in product information, reducing manual corrections and enabling faster coordination between suppliers, central teams, and digital channels.

- Accelerated internal adoption, thanks to a smart MVP approach, which helped teams embrace the new tools and focus on more strategic work.

- Tangible business value, with improved collaboration, stronger supplier alignment, and more reliable data driving faster and better decisions.

Another example comes from Brazil, where Nestlé developed an AI-powered platform called SISO (Sell-In Sell-Out) to support collaboration with major food retailers. By connecting sell-in and sell-out data through AI and data science, Nestlé enabled better demand forecasting, logistics optimization, and reduced stockouts by up to 35%. This shows how AI can unlock faster, safer, and more effective collaboration at scale.

What makes this model particularly powerful is its scalability. Once the foundations are in place, with good governance, interoperable systems and trustworthy data, AI technologies can scale collaboration across partners by automating workflows, campaign monitoring, or product recommendations using shared data.

Retailers that embed AI into their collaborative strategies, will get smoother operations, faster responses, and smarter decisions, making data sharing an engine for collective growth.

Beyond One-to-One: Building the Retail Data Ecosystem of the Future

At the end of the day, relying on one-to-one data exchanges between retailers and suppliers, through isolated contracts or manual sharing is a limited model that often leads to inefficiencies and missed opportunities for both sides. The real value is made up of building connected ecosystems where high-quality data flows securely and at scale through collaboration platforms like clean rooms. This model brings a set of benefits:

- Privacy-first sharing: Ensures sensitive information is protected, with clear governance and control.

- Scalability: One connection unlocks collaboration with multiple partners, instead of repeating integrations one by one.

- Faster, smarter decisions: Shared insights lead to more precise targeting, better stock management, and dynamic pricing.

- Commercial upside: Retailers can monetize data responsibly, opening new revenue streams through media and analytics.

- Stronger partnerships: Retailers and suppliers move from transactional to strategic relationships, building long-term value together.

This isn’t just about doing data better: it’s about shaping the future of how the retail ecosystem operates and grows. Retailers that treat data collaboration as a core capability—not just a project—will be best positioned to lead in an increasingly AI-powered and customer-centric landscape.

References

- Artefact – AI and Competitiveness: Five Predictions for Retail by 2030.

- Artefact – ADEO – Improving product referencing speed and quality with AI.

- Artefact – Data & AI for Retail.

- Bain & Company – No More Easy Money on the Side: Retail Media Enters the Performance Era

- DigitalWave Technology – Breaking Down Data Silos: Why Retailers Need Unified Data to Stay Competitive

- Grand View Research – Artificial Intelligence In Retail Market Size, Share & Trends Analysis Report

- Introduction to Secure Collaboration With Data Clean Rooms

- LiveRamp – ASICS Leverages Unique Incrementality Capabilities to Drive Global Sales

- LiveRamp – LiveRamp Joins Carrefour’s Digital Day 2021: The Future of Data Collaboration in Retail

- LiveRamp – Unlocking Data Collaboration to Achieve Retail Transformation: Our Journey with Carrefour

- Nestlé – Nestlé utiliza Inteligência Artificial e Ciência de Dados para apoiar parceiros na gestão de estoque reduzindo em 35% a ruptura em loja

- SalesForce – 85% of IT Leaders See AI Boosting Productivity, but Data Integration and Overwhelmed Teams Hinder Success

BLOG

BLOG