The number of flights per year increased steadily in the years leading up to the pandemic – there were just under 47 million flights in global aviation in 2019. In 2020, however, the number of global flights dropped dramatically to around 22 million due to the impact of the pandemic. By 2022, however, we see the trend reversing again and the number of global flights increasing again, but it is still below pre-pandemic levels at around 32 million. We can look forward to seeing what the values will be for 2023.

This year’s early booking and now last minute season has also come to an end and major airlines have drawn their first conclusions of the 2023 travel year. Lufthansa, for example, announced that it expects a record year in 2023, thanks to increased profits per passenger due to higher ticket costs. Already in April, the portal Idealo had published a price comparison analysis where it was noted that the airfares to numerous popular destinations on the Mediterranean have increased by an average of 32 percent compared to the previous year – and this regardless of the travel time.

Despite the significant slump in recent years, most of the major price comparison websites and online travel agencies (OTAs) have survived these difficult times and have even expanded or are expanding their portfolios. Booking.com should be mentioned here, for example, whose competencies have included flight search since 2022.

It is therefore worth taking a look at the exciting market of airfare comparison websites, which is certainly all the more popular with travelers due to the sharp rise in prices in some cases. Which players are there in the market? What is their relevance to the markets in which they´re active as a travel advertiser? How do such comparison sites work, what should you consider for a cooperation?

What are metasearch engines in the travel sector?

Everyone who flies frequently knows them: price comparison sites and online travel agencies to find the cheapest flight. Whether it is a vacation or a business trip, airline passengers want to find and book the best flight for them at the lowest price. Whether it is a price comparison site (metasearch engine) or an OTA (online travel agency), the difference is usually whether only the airfares are displayed and you are redirected to the actual airline site to complete the booking, or whether you complete the booking directly with the online agency and thus do not book the ticket directly with the operating airline.

Since the air transport sector is a polypole, i.e. a market driven by competition with many players, it quickly becomes unclear for the individual user which airline even operates on the desired route, let alone which airline offers the best deal.

In order to create the best possible overview, there are price comparison sites (metasearch engines, or MSEs for short). An MSE is not necessarily a pure flight comparison site, but can also be a generic price comparison site in general. The overarching goal of all comparison sites, i.e. all MSEs, is thus to filter out the desired product for the user at the best possible price-performance ratio from the vast number of options.

Prominent examples of such comparison sites in the travel segment are Skyscanner, Kayak, Momondo, Swoodoo and Idealo.

Among other things, they all share the aforementioned overarching goal of finding the best possible price-performance ratio for the desired product, in our case airline tickets, and then forwarding the user to the page of the selected airline to ultimately book the ticket there. But they differ in scope and orientation. While Swoodoo, for example, is very focused on flights, Idealo also offers a flight fare comparison, but has a much more generic focus, since in addition to flights and hotels, the shopping area is also a strong focus. Thus, another unifying element is that all the sites mentioned have a flight search engine, but with different focuses or prioritizations.

How has the market evolved around airfare comparison sites?

Over the last few years, the market has consolidated more and more, resulting in the emergence of large groups from individual independent search engines or in the acquisition of holdings. It is not always easy to keep an overview. Booking Holdings (formerly Priceline Group) has bought up many competitors in recent years and now has a large number of search and booking platforms, of which the best known are probably booking.com (OTA) and Kayak (MSE). The Kayak Group, in turn, also includes well-known platforms such as Momondo, Swoodoo and Cheapflights.

Further acquisitions and consolidations also took place from the Asian market. In addition to Trip.com and ctrip.com (themselves an OTA), trip.com Group Limited, formerly Ctrip.com International, also operates one of the most internationally successful flight searches through the acquisition of Skyscanner, which cost around GBP 1.4 billion in 2016.

It can be seen that especially large MSE fall under one holding and thus a large oligopoly has emerged in the market in the background. Apart from the large holdings in the market, Google has also made it much more challenging over the last few years with the integration of flight search for smaller metasearchers to exist in this market at all with just a pure flight search.

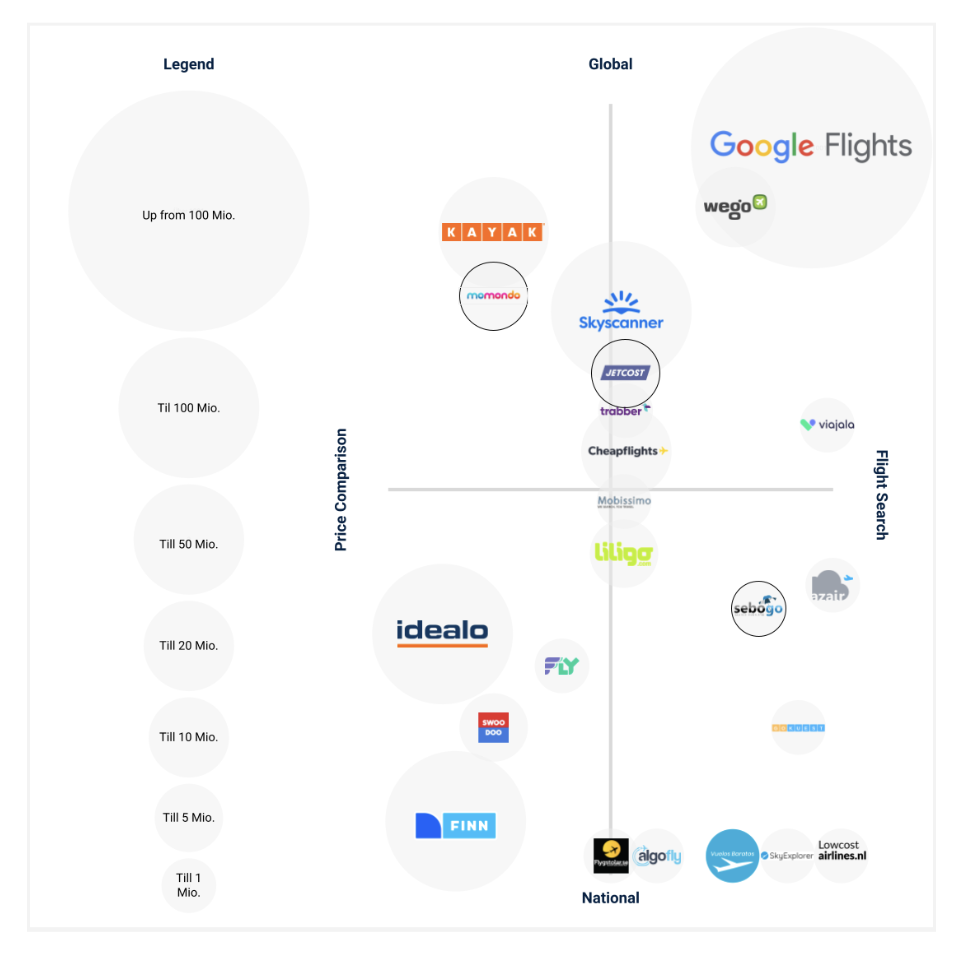

The following matrix is intended to provide an overview of the current status quo in the airfare MSE market. On the one hand, it shows which market participants offer a pure flight search or a general price comparison for different industries. In addition, the degree of internationalization is also shown. Is the provider nationally limited or does it possibly even operate globally? In addition, traffic data from Similarweb will also be used to illustrate relevance.

Source: Own representation. Traffic values are based on Similarweb.com values (as of August 2023).

What is the mode of operation of such MSEs?

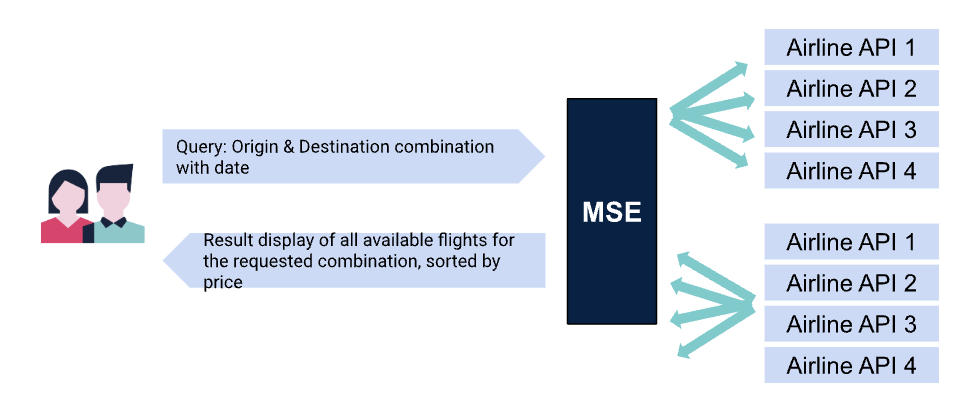

Basically, an MSE requires all data that is relevant for a flight booking. This includes the available routes of the individual airlines, current ticket prices in real time, and availability in the booking classes. This data must be made available accordingly. Airlines usually offer so-called data APIs for this purpose.

As soon as a user searches in the flight search for a certain route at a certain time, the MSE sends data requests to all APIs to which it has a connection. These APIs contain all flights with the corresponding information. They use the information from the request to search for all matching flights and send this information back to the MSE in a response.

Source: Own representation

The comparison site must then decode the information received and present it clearly so that a user can obtain an uncomplicated overview of prices, availability, flight times and connections for the flight route he or she is requesting (combination of origin, i.e. departure airport, and destination, i.e. destination airport). Since this process usually involves querying not just one API, but a large number of them, it usually takes a few seconds before the user has a complete list of all flights.

Challenges and solutions for the travel industry

Since there are now a large number of comparison sites, it can sometimes be challenging for an airline to muster the necessary resources to give every MSE access to its own API.

Artefact, which has been cooperating closely with the Lufthansa Group for many years and also manages large parts of the metasearch channel for them, also enables smaller MSEs to make their requests bundled via their own intermediate API. Thus, it was no longer necessary for the advertiser to provide each individual MSE with access to its own API. Instead, this is bundled via Artifact’s intermediate solution, which thus acts as a so-called proxy.

In this context, Artefact also filters out those MSE requests that do not result in a response from the API (e.g. because certain routes are not provided for in the flight plan, do not make sense or have been requested several times within a very short time, etc.), thus reducing the volume of requests to the airline’s API and, under certain circumstances, can also deliver faster responses to the MSEs. Even if the advertiser does not have an API, but only a product data feed (CSV, XML), Artefact’s solution can act as an API to the MSEs and thus enable and simplify collaboration.

In addition, Artefact is available to assist each individual metasearcher with any questions regarding the affiliate and metasearch program, thus acting as the link between the advertiser and the individual MSEs to provide the best possible and most efficient service for all parties.

Do you operate a flight search and would like to discuss the possibility of cooperation with us and our travel customers? Or are you an advertiser in the travel segment and need support in working with a MSE? Then please feel free to contact us:

BLOG

BLOG