Customer Data Platforms (CDPs) are one of the key technological enablers for staying competitive in a rapidly evolving industry landscape.

CDPs aggregate, segment, and leverage data from multiple sources to create a 360-degree view of the customer. As a result, organizations can deliver targeted marketing strategies and seamless, loyalty-building user experiences. In banking, where the protection of personal data is especially important, a CDP should be secure, easy to use, reliable and scalable.

Regulatory challenges and the rise of first-party data

Financial services organizations, from banks and insurers to brokers and investment managers, are facing a myriad of challenges in leveraging data effectively. The adoption of new technologies is accelerating; staying ahead of the curve is imperative for sustainable growth. But with increased digitization comes heightened regulatory scrutiny and the need for robust data security measures. In finance-related industries, financial tracking, cybersecurity and the risk of breaches are serious concerns.

Privacy regulations, such as GDPR and CCPA, are becoming increasingly stringent as customers and governments attempt to curb improper use of data. These regulations, along with the deprecation of third-party cookies, necessitate a shift by financial service providers towards the use of first-party data that is gathered and owned by the company itself.

With a CDP, banks can assess customer risk profiles more accurately. This helps in making informed lending decisions, reducing default rates, and ensuring compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations, emphasizing the importance of building trust with customers through transparent data practices.

Ultimate personalization for enhanced customer experiences

While the trend is toward privacy, customers are also increasingly aware of the value they can gain by sharing their data with trusted providers. However, they are highly selective about what information they are willing to share and with whom. In return for their data, customers expect to receive value from a brand. For banking and insurance, that means a personalized experience that offers clients a view of the financial products most relevant to them.

“One of the key capabilities that CDPs bring to the table is to provide a seamless integrated omnichannel customer journey. It’s not just about generating more leads or more revenue, it’s about increasing customer lifetime value.”Athena Sharma, Sr. Director, Financial Services Lead at Artefact UK

Personalization has become a cornerstone of customer engagement strategies across many industries. Because CDPs centralize, unify and enrich all first, second and third party data, they can offer deeper insights into customer preferences and behaviors, enabling targeted marketing campaigns and customized product offerings. CDPs also enable advanced segmentation and signal identification.

The ability of organizations to provide a connected, omnichannel experience is critical to meeting evolving customer expectations, preventing churn, and fostering long-term loyalty.

Overcoming legacy system limitations

Legacy systems often fail to deliver real-time insights and personalized engagement opportunities to customers. Retail banks and insurance companies struggle to provide timely and contextually relevant communications, resulting in missed opportunities to enhance customer satisfaction and drive revenue growth.

Even DMPs (data management platform: the CDP’s predecessor) can no longer meet these challenges due to their limitations in providing individual-level insights, lack of real-time data activation capabilities, inadequate compliance features, and inability to deliver the level of personalization demanded by today’s consumers.

CDPs address these limitations by providing a unified platform for data integration and analysis. By harnessing the power of machine learning and predictive analytics, organizations can unlock actionable insights and drive revenue growth through targeted cross-selling and upselling initiatives.

“Data isn’t just for activation; it also helps relationship managers, whether they’re working digitally or sitting physically in a bank, understand the customer who walks through the door, makes a phone call or exchanges emails.”Akhilesh Kale, Partner at Artefact US

Six steps to successful CDP implementation

CDP deployment requires careful planning and execution in order to deliver on its potential. Organizations must assess their data maturity, define clear use cases, and select the right vendor and toolset. Seamless integration with existing systems and ongoing performance evaluation are essential to maximize ROI and drive continuous improvement.

1) Data maturity assessment

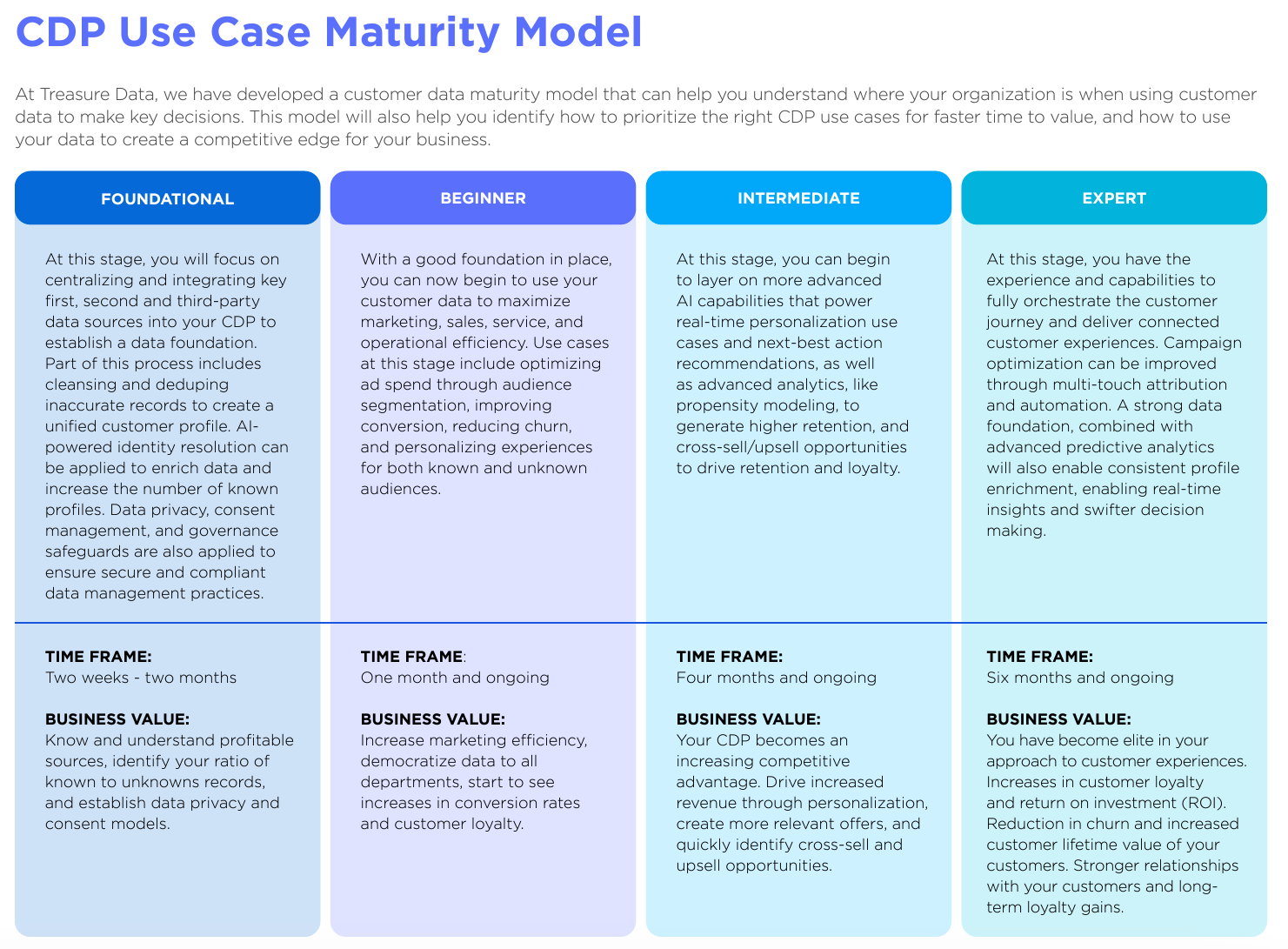

To determine whether a company has the appropriate level of maturity to fully benefit from a CDP, it’s essential to benchmark all areas of organizational maturity against best practice. Will a CDP serve current strategic needs and receive the necessary investment of time and resources from the business?

2) Requirements development

To build a successful roadmap, it’s necessary to evaluate which use cases are the priority for the business in question. Which uses will deliver the most value fastest? Requirements will differ depending on an organization’s data maturity: more complicated use cases may require implementing machine learning and predictive analytics, and need more complicated infrastructure to support them.

3) Choosing the right vendor and tool

There are choices in the market for differing budgets and ambitions, including pure players, cloud natives and CRM integrators. As with all large scale tool deployments, make or buy is a consideration. Other factors to consider include data collection and ownership, customization, evolutivity, partner transparency, security and more.

4) Smooth implementation

CDP implementation requires a significant investment in both time and money. The process should be as seamless and optimized as possible. To ensure adoption after roll-out, training and familiarization must be provided. Most vendors are experienced in implementing CDP solutions and can provide support and guidance.

5) Run and evaluate

Once the CDP is operational, improvement should be continuous. Evaluating the quality of insights produced and how they are successfully acted upon is essential to fully leverage use cases. Appropriate ways of working and operating models need to be put in place to maintain the feedback loop.

6) Advanced AI use cases

As organizations mature in their data capabilities, the path to advanced AI-driven use cases becomes increasingly accessible. Leveraging AI, machine learning, and predictive analytics can unlock new opportunities for data-driven decision-making and competitive differentiation. By embracing innovation and harnessing the power of CDPs, financial institutions can position themselves for success in an increasingly digital world.

“I’m excited about the future of AI because I think there’s a lot that CDPs can contribute, and from a collaborative perspective, with AI they’ll be able to deliver better customer experiences for banking and financial services customers.”Thomas Kurian, Senior Director of Strategy at Treasure Data

Customer Data Platforms are a transformative tool for financial services organizations seeking to unlock growth, enhance customer experiences, and navigate the complexities of modern data management. By harnessing the power of data, organizations can drive operational efficiency, mitigate risks, and capitalize on emerging opportunities in a rapidly evolving market landscape.

To learn more about CDPs and the challenges and opportunities for retail banks, insurance providers and investment managers, watch a replay of the Treasure Data, CDP Institute & Artefact webinar, “Connected Customer Experience with CDPs: Accelerating customer growth and profitability for Banking, Insurance, and Investment Management.”

BLOG

BLOG