Cet article fait partie de notre livre électronique Artefact Data for Tourism.

Alors que plusieurs pays de la région MENA et d'ailleurs s'efforcent de renforcer leur position en tant que destinations touristiques mondiales et centres de voyage, l'analyse et l'intelligence du site data sont devenues cruciales pour établir une présence mondiale et gagner un avantage concurrentiel. En fait, data peut aider les destinations émergentes à sortir de l'impasse de la croissance en favorisant l'excellence du marketing, en stimulant la création de l'offre et en améliorant l'expérience des visiteurs.

Introduction

Après avoir atteint un sommet d'environ 1,5 milliard d'arrivées de touristes internationaux en 2019, les voyages se sont effondrés pour devenir quasiment nuls, la pandémie de COVID-19 ayant soudainement et de manière dévastatrice paralysé l'industrie. Avant la pandémie, le tourisme était devenu l'un des principaux secteurs socio-économiques du monde, avec des recettes d'exportation en 2019 s'élevant à 1,7 billion USD, soit 28 % du commerce mondial des services et 7 % des exportations globales de biens et de services.

Parmi les plus durement touchés, on trouve les pays dépendant du tourisme et les destinations touristiques émergentes qui disposent de moins de ressources économiques et techniques pour répondre à la crise : "Dans un secteur qui emploie 1 personne sur 10 dans le monde, l'exploitation de l'innovation et de la numérisation, l'adoption des valeurs locales et la création d'emplois décents pour tous - en particulier pour les jeunes, les femmes et les groupes les plus vulnérables de nos sociétés - pourraient être à l'avant-garde de la reprise du tourisme", déclare le secrétaire général de l'Organisation mondiale du tourisme (OMT), Zurab Pololikashvili.

Malgré leur attrait croissant pour les touristes, peu d'études ont analysé l'économie du tourisme dans les destinations émergentes au cours des premières étapes de leur cycle de vie, la littérature se concentrant principalement sur les destinations plus établies. Les destinations touristiques émergentes ont un potentiel important ; cependant, les décideurs politiques et les gestionnaires de ces destinations doivent encore faire des efforts considérables pour transformer les atouts culturels et les attractions en produits touristiques attrayants qui peuvent être compétitifs sur les marchés mondiaux.

Pour permettre aux destinations touristiques émergentes de se faire une place sur la carte mondiale, des décisions data doivent être prises sur une base multilatérale. Il faut une volonté politique, un positionnement clair de la destination, une stratégie "intelligente" et des investissements ciblés dans le secteur pour libérer le potentiel unique de ces destinations. "Le retour du tourisme permettra à ces communautés de se remettre sur pied, non pas grâce à l'aide, mais en partageant à nouveau leur culture, leur patrimoine et leur hospitalité avec le monde entier", affirme M. Pololikashvili.

Source : Base de données de l'OMT sur le tourisme récepteur : Base de données de l'OMT sur le tourisme récepteur, communiqués de presse de l'OMT, bibliothèque Artefact des cas d'utilisation du tourisme data , recherche documentaire sur le tourisme data et les initiatives numériques.

L'impasse de la croissance des destinations touristiques émergentes

Selon l'Organisation mondiale du tourisme des Nations unies (OMT), le secteur du tourisme a connu une reprise impressionnante : plus de 900 millions de touristes ont voyagé à l'étranger en 2022, soit deux fois plus qu'en 2021. En outre, au premier trimestre 2023, on estime que 235 millions de touristes ont voyagé à l'étranger, soit plus du double par rapport à la même période en 2022.

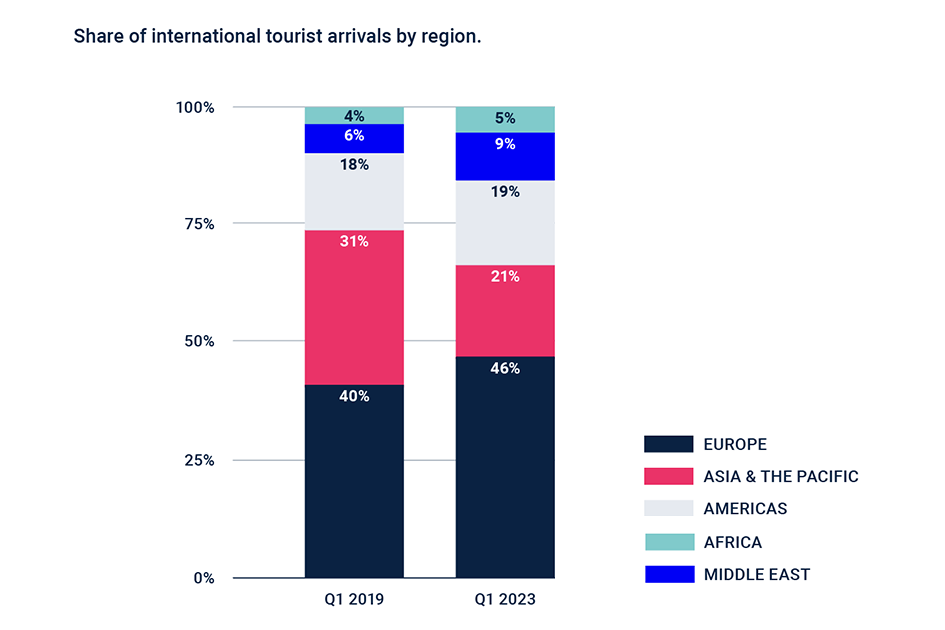

Si les destinations émergentes ont augmenté leur part des arrivées de touristes internationaux post-covid par rapport à 2019, en particulier au Moyen-Orient (9 % au T1 2023 contre 6 % au T1 2019), les destinations établies se taillent toujours la part du lion des arrivées de touristes internationaux, l'Europe représentant 46 % au T1 2023 (contre 40 % au T1 2019), suivie par l'Asie & le Pacifique à 21 % (contre 31 % au T1 2019), et les Amériques à 19 % (contre 18 % au T1 2019).

En outre, les destinations émergentes sont confrontées à d'importants défis, tels que l'inflation élevée et la hausse des prix du pétrole, qui entraîneront une augmentation des coûts d'hébergement et de voyage, poussant les touristes à "rechercher de plus en plus un bon rapport qualité-prix et à voyager plus près de chez eux", comme le prévient le groupe d'experts de l'OMT.

Dans ce contexte, les nouvelles destinations touristiques ont du mal à être compétitives et à se faire une place sur la carte du monde, et ce pour plusieurs raisons. Tout d'abord, la notoriété de leur marque est inférieure à celle des destinations plus établies.

Ensuite, elles disposent généralement d'une infrastructure limitée pour accueillir un grand nombre de visiteurs et d'une expertise moindre pour offrir des expériences distinctives afin de les attirer.

Enfin, elles ne sont souvent pas très visibles sur le radar des investisseurs régionaux et internationaux et des partenaires industriels. Tous ces facteurs créent une impasse de croissance : la faible notoriété d'une destination touristique se traduit par un attrait touristique limité et un nombre restreint de visiteurs nationaux et étrangers, ce qui incite les investisseurs et les acteurs du secteur à ne pas donner la priorité à la destination. Cette situation empêche à son tour le développement réussi de l'offre touristique, et le cycle se répète.

Comment une nouvelle destination touristique peut-elle sortir de l'impasse de la croissance et émerger pour devenir mondialement reconnue ? Les offices de tourisme et les autorités responsables des destinations doivent tirer parti de l'intelligence data et des technologies numériques pour être sur un pied d'égalité.

Consacrer des ressources au développement des capacités de collecte, d'analyse et d'activation des connaissances sur le site data est aujourd'hui une nécessité plutôt qu'une ambition. C'est particulièrement vrai dans un contexte post-pandémique, où les voyages s'accélèrent rapidement et offrent aux destinations touristiques émergentes des possibilités sans précédent de capter une plus grande part des touristes, tous à la recherche de nouvelles aventures après deux années de restrictions sur les voyages.

ARTEFACT CONTRIBUTEURS :

Anthony Cassab, Anthony Hanna, Hemanth Mandava, Faisal Najmuddin et Andrei Dogaru

BLOG

BLOG