Este artículo forma parte de nuestro eBook Artefact Data for Tourism.

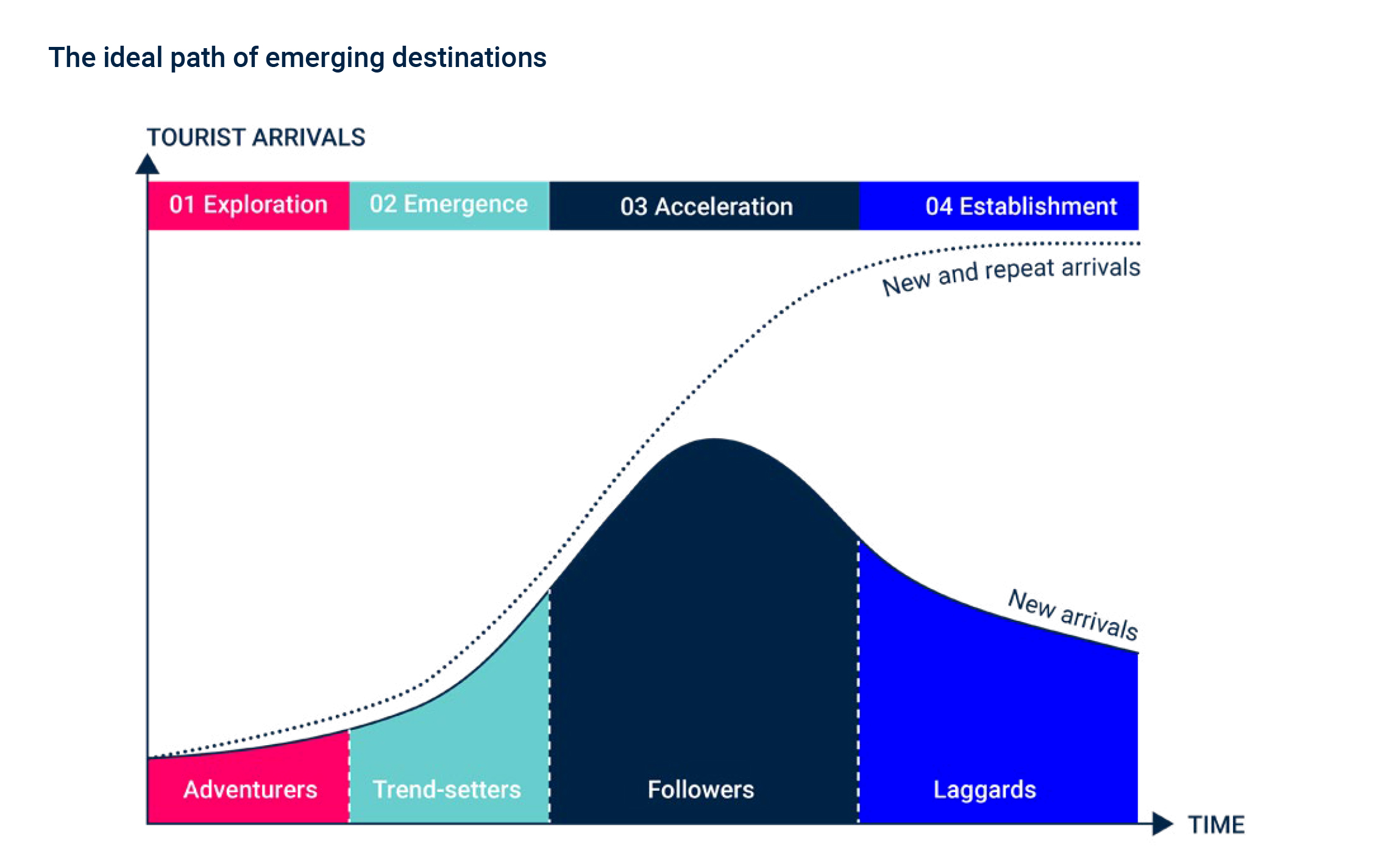

Un destino emergente debe asegurarse una masa crítica para ser reconocido como un destino de "visita obligada". El siguiente diagrama ilustra las cuatro fases de este tipo de destinos turísticos. Esta evolución representa la vía de crecimiento ideal; aunque no todos los destinos son capaces de alcanzar las fases avanzadas, éste debería ser su objetivo.

Para lograr esta trayectoria de crecimiento, los patronatos de turismo deben desarrollar estrategias "inteligentes" para atraer a nuevos visitantes en cada etapa, centrándose en cuatro áreas clave interdependientes: construir la marca, estimular la demanda turística, mejorar la experiencia turística y atraer inversiones y ofertas turísticas.

1 - La fase de "exploración

El destino es de reciente introducción y tanto los visitantes internacionales como los nacionales son escasos. La atención se centra en construir la propuesta de valor del destino para empezar a desarrollar la estrategia de marketing con el fin de aumentar los índices de visitas y atraer turistas. El objetivo en esta fase inicial es captar visitantes nacionales, por lo que los esfuerzos de marketing deben centrarse en este segmento turístico.

En esta fase es igualmente importante capitalizar los activos naturales del destino para crear una oferta turística básica. Los casos de éxito ponen de relieve un enfoque de "oferta mínima viable" de baja inversión, en el que la oficina de turismo o la autoridad del destino organizan eventos en el destino para promocionar parajes naturales específicos y desarrollan opciones de alojamiento sostenibles y de construcción sencilla, al tiempo que ofrecen experiencias indulgentes en el ecosistema natural del destino para atraer a los primeros visitantes ávidos de viajes ("aventureros''). La inversión pública también será necesaria para desarrollar las infraestructuras esenciales (por ejemplo, transporte, servicios públicos, etc.) para que los turistas puedan acceder al destino con facilidad y dispongan de los servicios básicos.

Una vez puestas en marcha estas iniciativas, las oficinas de turismo o las autoridades del destino deberían empezar a colaborar con los operadores turísticos (OT), las agencias de viajes (AT) y las empresas de gestión de destinos (DMC) para crear paquetes de viajes dentro del destino, ya que los turistas no estarían dispuestos a hacer reservas directas. Como mínimo, habría que animar a los operadores turísticos, las agencias de viajes y las empresas de gestión de destinos a incluir el destino en sus paquetes más amplios (por ejemplo, como excursión de un día o pernoctación de camino a un destino "establecido").

Paralelamente, es crucial que las oficinas de turismo o las autoridades del destino empiecen a recopilar sistemáticamente información en data para comprender la experiencia del turista. Las mejores prácticas en esta etapa incluyen la realización de encuestas para captar la satisfacción y los puntos débiles, así como la probabilidad de aprobación de los primeros visitantes; estas métricas deben compararse con los puntos débiles de la experiencia y los placeres de los destinos competidores para identificar las áreas prioritarias de mejora.

2 - La fase de "emergencia

El destino atrae ahora a "creadores de tendencias", turistas receptivos a los esfuerzos de marketing, dispuestos a comprometerse e intrigados por las experiencias de los "aventureros", que quieren seguir su ejemplo. En esta fase, los esfuerzos de marketing deben centrarse en cristalizar la propuesta de valor del destino para empezar a atraer visitantes internacionales.

Los patronatos de turismo o las autoridades del destino deberían tomar medidas para estimular la inversión privada nacional mediante la participación de grandes agentes locales. Se les debe incentivar para que inviertan en ampliar la oferta turística del destino, desde la construcción de mejores opciones de alojamiento hasta la creación de nuevas atracciones y experiencias. Al mismo tiempo, las iniciativas gubernamentales deben seguir ampliando las infraestructuras existentes.

Se seguirá dependiendo de las agencias de viajes, las agencias de turismo y los centros de gestión de destinos para crear paquetes de viajes e impulsar la demanda turística, aunque ahora pueden dirigirse a visitantes internacionales. Además, hay que tener en cuenta que los esfuerzos para crear una presencia en los agregadores de viajes en línea más conocidos (OTA, por sus siglas en inglés, como Booking.com, Tripadvisor, etc.) deben comenzar en esta fase, ya que lleva tiempo conseguir visibilidad en estas plataformas.

Data La recopilación de datos para medir la experiencia turística debe continuar y ampliarse mediante la realización de encuestas a visitantes internacionales. También debería disponerse de un volumen suficiente de reseñas y compromisos en las redes sociales, lo que permitiría realizar análisis de las mismas y utilizarlos para mejorar los ejercicios de evaluación comparativa. Además, el sitio web data disponible debería prepararse para su publicación como conjunto de datos públicos y aprovecharse para proporcionar un amplio apoyo a la modelización precisa del rendimiento de la inversión con el fin de ganar la confianza de los inversores.

3 - La fase de "aceleración

En esta fase, el destino se ha asegurado la masa crítica necesaria para atraer turistas de forma orgánica a través del boca a boca y las recomendaciones de los visitantes. Por tanto, el marketing debe centrarse en promocionar atracciones y experiencias específicas, y dirigirse a segmentos de turistas seleccionados aprovechando los análisis de marketing de precisión para aumentar las tasas de conversión y el retorno de la inversión en marketing.

La oficina de turismo o la autoridad del destino deberían fomentar activamente la inversión extranjera directa mediante asociaciones con los principales agentes mundiales del sector, que ampliarán la oferta turística creada por los agentes nacionales, aportando más opciones de alojamiento y experiencias más diversas. Además, a medida que los turistas se familiaricen más con el destino y empiecen a hacer reservas directas, deberán reforzarse las asociaciones con las OTA mundiales, y las OT/TA deberán adaptar su Servicios para ofrecer paquetes de experiencias y atracciones específicas.

Deberían aprovecharse los análisis avanzados de las redes sociales para priorizar los puntos débiles y los placeres de la experiencia del turista, y debería sacarse partido de otros recursos disponibles en data , que ahora se ponen a disposición del público para generar información comercial para los inversores.

4 - La fase de "establecimiento

El valor de marca del destino debe ser lo suficientemente alto como para que los esfuerzos de marketing puedan dirigirse principalmente a la promoción de nuevas experiencias y atracciones. La oficina de turismo o la autoridad del destino deben centrarse en políticas y medidas para aumentar el gasto de los turistas, ofrecer experiencias de alta calidad a los visitantes y mantener una sólida puntuación neta de los promotores.

En general, en esta fase debería haber poca intervención de las autoridades gubernamentales en lo que se refiere a la creación de oferta turística, ya que el destino sería atractivo desde el punto de vista de la inversión para los agentes del sector privado que busquen una rentabilidad atractiva. Desde el punto de vista de la demanda, la mayoría de las reservas las harían directamente los turistas, lo que reduciría considerablemente la dependencia de las OT/TA.

La experiencia turística data también debería ser ahora lo suficientemente rica como para permitir análisis avanzados que personalicen la experiencia turística, como los motores de recomendación personalizada basados en AI para la planificación de itinerarios y experiencias.

ARTEFACT COLABORADORES:

Anthony Cassab, Anthony Hanna, Hemanth Mandava, Faisal Najmuddin y Andrei Dogaru

BLOG

BLOG